Most people think the best travel credit cards cost a fortune in yearly fees and come packed with fancy lounge access. But what if there was a card that gave you solid rewards without emptying your wallet? The American Express Green Card might just surprise you with how much value it offers everyday travelers. Whether you’re booking weekend getaways or grabbing dinner before a flight, this card rewards the spending you already do.

1. Strong Travel Rewards That Add Up Fast

Getting 3 points for every dollar spent might not sound flashy, but it builds up surprisingly quick. Travel purchases like flights and hotels earn triple points, along with transit options such as trains, buses, and rideshares. Restaurants across the United States also qualify, including takeout and delivery orders from your favorite spots.

Points stay flexible too, letting you redeem through travel portals and partners like Airbnb, Expedia, and TripAdvisor. Regular spending turns into real travel opportunities without needing expensive vacations. Everyday purchases keep your points balance growing steadily, making weekend trips and longer adventures more affordable throughout the year.

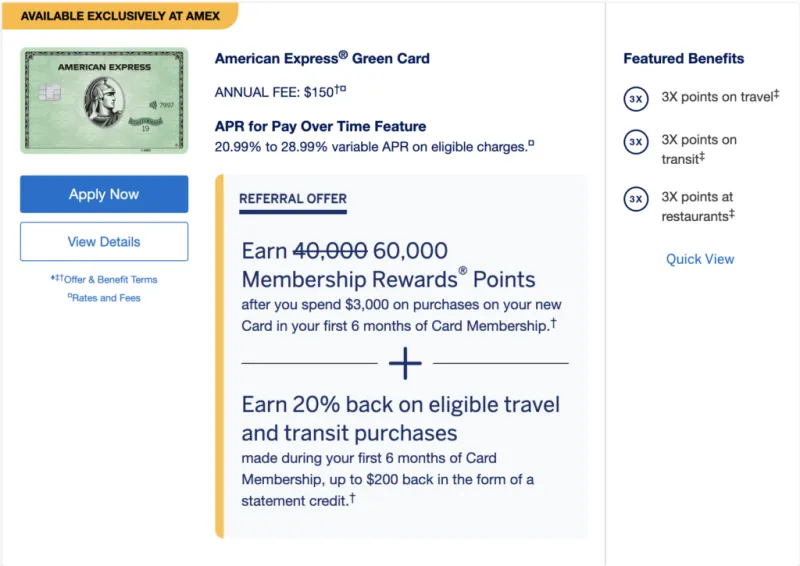

2. Annual Fee Won’t Break Your Budget

Premium travel cards often charge $500 or more each year, which feels steep for occasional travelers. At just $150 annually, the Green Card costs far less while still delivering meaningful perks. That difference means hundreds of extra dollars staying in your pocket instead of going toward card fees.

Budget-conscious travelers appreciate this balance between cost and benefits. You get quality rewards without paying premium prices designed for frequent flyers. Families planning multiple small trips find better value here than with expensive cards they can’t fully use. Lower fees make travel rewards accessible to more people who want smart spending options.

3. Welcome Bonus Kickstarts Your Travel Fund

New cardholders can earn up to 60,000 Membership Rewards points after spending $3,000 within six months. That spending requirement isn’t too demanding for most people covering regular expenses like groceries, gas, and bills. Hitting that target unlocks enough points for free flights or several hotel nights.

Imagine booking your next vacation without paying for airfare or accommodation. The welcome bonus essentially pays for a trip before you’ve even used the card long-term. Strategic planning around this offer maximizes value right from the start, giving you immediate travel opportunities instead of waiting years to accumulate rewards.

4. CLEAR Credit Speeds Through Airport Security

Standing in long security lines ruins the start of any trip, especially during busy travel seasons. Your Green Card provides up to $209 in annual statement credits toward CLEAR Plus membership, which lets you skip regular lines. Instead of waiting 30 minutes or more, you breeze through in minutes using biometric scanning.

This benefit alone nearly covers the card’s annual fee, making it essentially free. Frequent travelers save hours throughout the year while reducing pre-flight stress. Families with kids particularly appreciate faster security processing when managing luggage and little ones through busy airports.

5. Travel Insurance Protects Your Investment

Unexpected problems like flight delays, lost baggage, or rental car damage can ruin trips and drain your wallet. Built-in travel insurance through the Green Card covers these situations when you pay with your card. Trip delay coverage reimburses expenses if you’re stuck waiting, while baggage insurance protects against lost or damaged items.

Rental car protection saves you from buying expensive insurance at the counter, potentially saving $15-30 per day. Purchase protection even covers eligible items up to $50,000 annually if they’re damaged or stolen within 90 days. These safeguards provide peace of mind without extra insurance premiums.

6. Perfect for Everyday Travel Spending

You don’t need exotic international trips to benefit from this card’s rewards structure. Frequent dining out, ordering food delivery, taking rideshares, and booking domestic hotels all earn triple points. Solo travelers, couples, and small families accumulate rewards naturally through regular activities rather than expensive vacations.

Weekend road trips to nearby cities suddenly become more rewarding when hotel stays and restaurant meals earn points. Commuters using trains or buses for work even benefit from transit rewards. This everyday earning potential makes the card valuable for normal life, not just once-yearly big trips abroad.

7. Important Limitations to Keep in Mind

American Express isn’t accepted everywhere internationally, especially at smaller shops and restaurants in Europe, Asia, and South America. Always pack a Visa or Mastercard backup when traveling abroad to avoid payment problems. Some merchants prefer other card networks due to processing fees, leaving you unable to use your Green Card.

Reward categories focus heavily on U.S. spending, particularly dining and transit within America. International purchases still earn points but at lower rates for non-travel spending. Understanding these limitations helps set realistic expectations and prevents frustration when certain benefits don’t apply overseas.

8. Why This Card Surprises Travelers

Most people assume premium cards costing $500+ with lounge access and concierge services represent the best travel options. Marketing pushes expensive cards as status symbols rather than practical tools. The Green Card challenges this assumption by delivering solid value without unnecessary luxury features many travelers never use.

Affordability combined with meaningful rewards makes travel accessible to regular people, not just business executives with unlimited budgets. You get practical benefits like security fast-tracking and purchase protection instead of fancy perks gathering dust. This practical approach resonates with travelers prioritizing experiences over status, proving the best card depends on your actual needs.