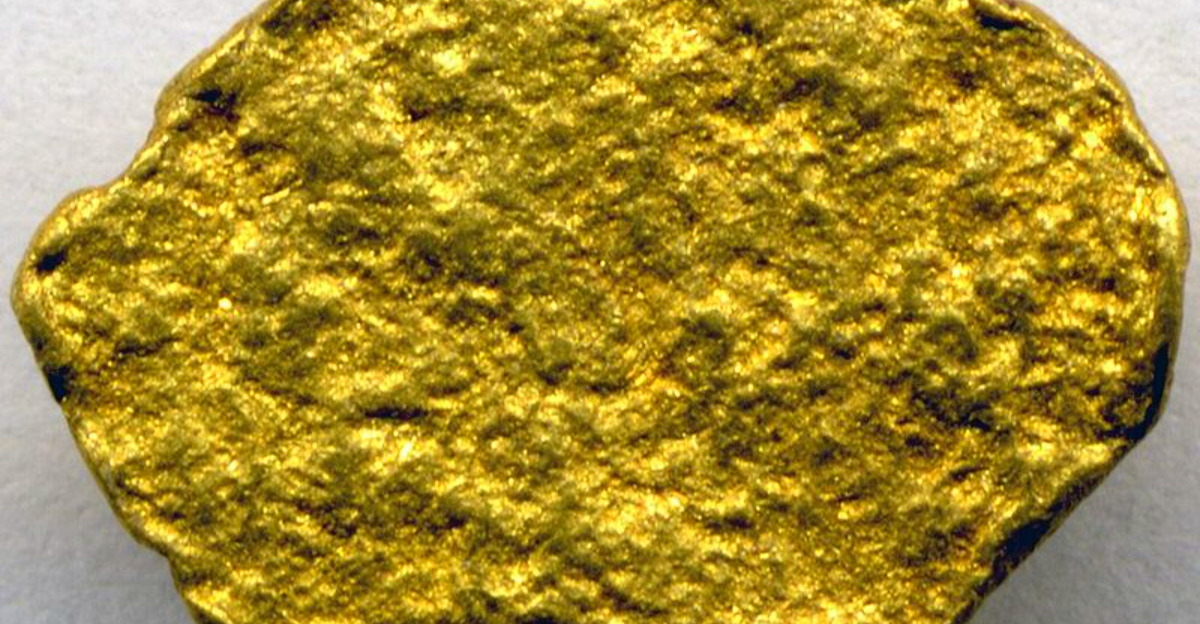

A colossal gold deposit has been discovered deep beneath China’s Hunan Province, containing an estimated 1,000 metric tons of gold and valued at nearly 600 billion yuan. This remarkable find places it among the largest known gold reserves on Earth, sparking excitement across the mining industry and global markets. The discovery not only reshapes our understanding of China’s mineral wealth but also raises important questions about the future of gold mining, exploration technology, and economic impact.

Beneath the Wangu goldfield in Hunan Province, China, geologists have uncovered what may become one of the most significant gold deposits ever recorded. The estimated reserve exceeds 1,000 metric tons of gold, a figure that places this discovery in rare company worldwide. Only a handful of gold deposits across the globe can claim such extraordinary volumes.

This announcement has sent ripples through international mining communities and financial markets alike. The sheer scale of the find suggests that decades of exploration and mining activity could follow. Hunan Province already had a reputation for mineral wealth, but this discovery elevates its status dramatically.

What makes this find particularly remarkable is not just the quantity but the geological confidence behind the estimate. Advanced drilling techniques and modern geological modeling have provided a detailed picture of what lies beneath. For China, this discovery represents a strategic asset that could influence gold markets and national reserves for generations to come.

While the total estimate reaches over 1,000 metric tons, geologists have already confirmed nearly 300 metric tons in the shallower layers of the deposit. These figures come from extensive drilling campaigns and careful analysis of rock samples brought to the surface. Confirmed resources represent gold that has been physically encountered and measured, giving investors and planners a solid foundation to work from.

Shallow deposits are generally easier and less expensive to mine than deeper ones. The confirmed 300 tons provide an immediate target for development and production planning. Mining companies often prioritize these upper zones because they require less infrastructure investment and can generate cash flow more quickly.

The distinction between confirmed and estimated resources is crucial in the mining industry. Confirmed tons mean that geologists have drilled through the rock, logged the core, and tested samples in laboratories. This level of certainty reduces risk and helps companies secure financing for development projects.

Chinese authorities have placed the deposit’s estimated value at close to 600 billion yuan, a staggering sum that has captured headlines around the world. To put this in perspective, that amount translates to roughly 83 billion US dollars at current exchange rates. Such valuations are based on the total estimated gold content multiplied by current market prices.

However, it is important to understand that this figure represents the theoretical value of the gold in the ground, not the actual profit a mining company would realize. Extracting gold from deep underground involves enormous costs, including labor, energy, equipment, environmental management, and regulatory compliance. The net value after all expenses could be significantly lower.

Still, even accounting for extraction costs, a deposit of this size represents a major economic asset. It could create thousands of jobs, generate substantial tax revenue, and contribute to China’s strategic gold reserves. The announcement has already influenced gold prices and sparked interest from international mining firms looking for partnership opportunities.

Geologists emphasize that early resource figures should be viewed as preliminary and subject to change. As drilling continues and more rock samples are analyzed, the estimates can shift upward or downward. This is a normal part of the exploration process and reflects the inherent uncertainty of working thousands of meters below the surface.

Initial estimates are based on limited data points, mathematical models, and assumptions about how gold veins behave underground. As more holes are drilled and more information is gathered, the picture becomes clearer. Sometimes additional drilling reveals that gold-rich zones extend further than expected, increasing the estimate. Other times, veins pinch out or become too low-grade to mine economically.

For investors and stakeholders, understanding this uncertainty is critical. Resource estimates come with confidence levels and classifications, such as inferred, indicated, and measured. The Wangu deposit is still in the early exploration stage, meaning much work remains before final, bankable numbers can be declared. Patience and continued investment in exploration will determine the true size and value of this discovery.

Exploration teams have identified more than 40 gold-bearing veins at depths around 2,000 meters below the surface. That is roughly 6,600 feet, or over a mile straight down. At these depths, the rock is under tremendous pressure, temperatures are higher, and accessing the ore becomes a complex engineering challenge.

Geological models suggest that these gold veins may extend even deeper, potentially reaching 3,000 meters. If confirmed, this would make the Wangu deposit one of the deepest significant gold mines in the world. Deep mining requires specialized equipment, advanced ventilation systems, and rigorous safety protocols to protect workers from heat, rock bursts, and other hazards.

The presence of 40 separate veins is encouraging because it suggests a large, interconnected mineral system rather than isolated pockets of gold. These veins likely formed millions of years ago when hot, mineral-rich fluids moved through fractures in the rock, depositing gold as they cooled. Understanding the geometry and continuity of these veins is essential for planning an efficient and safe mining operation.

What geologists have completed at Wangu is known in the industry as a first-pass assessment. This means they have moved from suspecting that gold might be present to confirming its existence through drilling and testing. It is an exciting milestone, but it is only the beginning of a long process.

First-pass assessments involve drilling a limited number of holes, analyzing the rock, and building preliminary models of the deposit. These models help geologists predict where gold is most concentrated and how much might be present. However, they are not yet detailed enough to support a mining decision or secure major financing.

The next steps involve infill drilling, which means drilling more holes between the initial ones to fill in the gaps and increase confidence in the estimates. Metallurgical testing will also be needed to determine how easily the gold can be separated from the rock. Environmental studies, permitting, and economic feasibility studies will follow. From first-pass assessment to production can take many years, but this discovery has passed a critical early test.

Gold grade refers to the concentration of gold in the ore, measured in grams per metric ton, or g/t. A higher grade means more gold per ton of rock, which generally translates to more efficient and profitable mining. Lower-grade deposits require processing larger volumes of rock to extract the same amount of gold, increasing costs and environmental impact.

For example, a gold grade of 5 g/t means that every ton of ore contains 5 grams of gold. High-grade deposits might have grades of 10 g/t or more, while low-grade deposits can be economically mined at 1 g/t or less, depending on the mining method and market conditions. The Wangu deposit has reported some very high-grade samples, but the average grade across the entire deposit is still being determined.

Understanding grade is essential for evaluating the economic potential of a gold discovery. Even a large deposit with low grades may not be profitable if extraction costs are too high. Conversely, a smaller deposit with very high grades can be highly lucrative. Grade, tonnage, depth, and mining costs all interact to determine whether a deposit is worth developing.

The exploration and analysis at Wangu were carried out by two key organizations: the Hunan Provincial Geological Survey and the Hunan Institute of Geology. These institutions have decades of experience mapping and studying the mineral resources of the region. Their work forms the scientific foundation for the current estimates and announcements.

Provincial geological surveys play a vital role in China’s mineral exploration strategy. They conduct regional mapping, identify promising areas, and often partner with mining companies to advance projects. The Hunan Institute of Geology contributes specialized expertise in structural geology, geochemistry, and ore deposit modeling, all of which are critical for understanding complex mineral systems like Wangu.

Having credible, experienced institutions behind the discovery lends weight to the findings. These are not speculative claims from a junior exploration company seeking investment, but rather the result of systematic, government-backed scientific work. Their reports will be scrutinized by international geologists and mining companies as the project moves forward, and their reputation depends on accuracy and transparency.

To appreciate the significance of the Wangu discovery, it helps to compare it with other major gold deposits around the world. South Africa’s South Deep mine, one of the largest and deepest gold mines on the planet, holds approximately 870 metric tons of proven and probable reserves. The Wangu estimate exceeds that figure, placing it in elite company.

Other notable deposits include Nevada’s Carlin Trend in the United States and the Super Pit in Australia, both of which have produced millions of ounces of gold over decades. However, few single deposits still in the ground today can claim reserves over 1,000 tons. Most of the world’s largest gold mines are mature operations that have been producing for many years, gradually depleting their reserves.

The discovery of a new, large deposit like Wangu is rare in the modern era. Most of the easy-to-find gold has already been discovered, and exploration companies are now looking deeper, in more remote locations, or using advanced technology to find hidden deposits. Wangu represents a major addition to global gold resources and could influence supply dynamics for years to come.

Discovering and confirming a deposit of this size requires cutting-edge geological methods and a tremendous amount of fieldwork. Exploration teams at Wangu logged tens of thousands of feet of drill core, which involves carefully examining and recording every inch of rock brought to the surface. Each core sample provides clues about the geology, mineralization, and structure of the deposit.

In addition to core logging, geologists mapped underground structures and built detailed 3D geological models. These models use data from drilling, geophysics, and geochemistry to visualize how gold veins are distributed in three dimensions. Advanced software allows geologists to rotate and slice through the model, predicting where the best ore might be found and guiding future drilling.

Geophysical surveys, which measure variations in the Earth’s magnetic field, gravity, or electrical conductivity, also played a role. These techniques help identify structures that might host gold mineralization. The combination of traditional fieldwork and modern technology has enabled the team to build a comprehensive picture of what lies beneath Wangu.

Geologist Chen Rulin, who has been closely involved with the project, reported that many of the drill cores contained visible gold. This is a highly encouraging sign for any exploration project. Visible gold means that the metal is present in concentrations high enough to be seen with the naked eye, often appearing as tiny flakes or specks within the rock.

The presence of visible gold suggests that the mineral system is robust and productive. In many gold deposits, the metal is so finely dispersed that it can only be detected through chemical analysis. When gold is visible, it often indicates higher grades and a more concentrated ore body, which can improve the economics of mining.

Visible gold also boosts confidence among investors and stakeholders. It provides tangible evidence that the deposit is real and significant. However, geologists caution that visible gold in a few samples does not guarantee that the entire deposit will be high-grade. Systematic sampling and analysis across the entire deposit are needed to determine the average grade and total resource.

Some of the samples from Wangu have yielded assays as high as 138 grams per ton, an exceptionally rich result that would thrill any geologist. However, it is crucial to understand that a single high-grade sample does not represent the average grade of the entire deposit. High-grade intercepts are often localized, occurring in narrow veins or enriched zones within the broader ore body.

When evaluating a deposit, geologists calculate an average grade by combining results from many samples across the entire mineralized zone. Some samples will be very high, some will be low, and most will fall somewhere in between. The average grade is what determines the economic viability of the project, not the best individual assay.

Reporting high-grade samples can generate excitement and attract investment, but experienced mining professionals know to look at the bigger picture. They want to see consistent grades across a large volume of rock, not just a few spectacular numbers. The ongoing drilling program at Wangu will help define the true average grade and ensure that expectations are grounded in reality.

Mining at depths of 2,000 to 3,000 meters presents significant challenges that can dramatically increase costs and complexity. As miners go deeper, they encounter higher rock temperatures, greater water inflow, and increased rock pressure, all of which require specialized equipment and engineering solutions. Ventilation becomes more difficult, as fresh air must be pumped down long shafts to keep workers safe and cool.

Energy consumption also rises with depth. Hoisting ore and waste rock from deep underground requires powerful machinery and consumes large amounts of electricity. Water pumping, cooling systems, and ground support all add to the operational costs. These factors can make deep mining less profitable than shallow mining, even if the ore grades are similar.

For Wangu to be successful, the gold veins must be thick, continuous, and high-grade enough to justify the expense of deep mining. Geologists and engineers will need to work closely to design a mining method that is safe, efficient, and economically viable. The depth of the deposit is both a challenge and an opportunity, as it may hold vast resources that have not yet been tapped.

The Wangu goldfield is located within the Jiangnan orogenic belt, a geological zone formed by ancient tectonic collisions that occurred hundreds of millions of years ago. During these collisions, massive forces folded and fractured the Earth’s crust, creating pathways for hot, mineral-rich fluids to rise from deep below. As these fluids cooled and interacted with surrounding rocks, they deposited gold and other metals.

Orogenic belts are well-known as favorable settings for gold deposits. The tectonic activity creates the fractures and faults that act as plumbing systems for mineralizing fluids. The Jiangnan belt has already produced several significant gold and other metal deposits, making it a prime target for exploration. Understanding the geological history and structure of the region helps geologists predict where new deposits might be found.

The geological setting at Wangu not only explains why gold is present but also suggests that there may be additional undiscovered deposits nearby. Regional exploration programs are likely to intensify as companies seek to capitalize on the favorable geology. The discovery at Wangu could mark the beginning of a new gold mining district in Hunan Province.

The excitement surrounding the Wangu discovery is well-founded, but the hard work is just beginning. The next phase of exploration will involve extensive infill drilling to refine resource estimates and test whether the gold-rich zones are thick and continuous enough to support a long-term mining operation. This phase is critical for determining whether the deposit can be mined safely and profitably for decades.

Engineers will also conduct feasibility studies to evaluate different mining methods, estimate costs, and project revenues. Environmental impact assessments will identify potential risks and mitigation measures. Permitting and community engagement will be necessary to gain social license and regulatory approval. All of these steps take time and require significant investment.

If the results continue to be positive, Wangu could become one of the world’s premier gold mines, operating for 30 years or more and producing millions of ounces of gold. However, if the ore proves to be too deep, too low-grade, or too difficult to mine, the project may not proceed. The coming months and years will be crucial in determining the ultimate fate of this remarkable discovery.