If taxes are eating your paycheck, moving could be your smartest money move this year. These cities combine no state income tax or comparatively lighter burdens with vibrant economies and amenities you will actually enjoy. You will see how far your salary can stretch when taxes are dialed down and everyday costs are manageable. Let’s explore where your money can finally breathe.

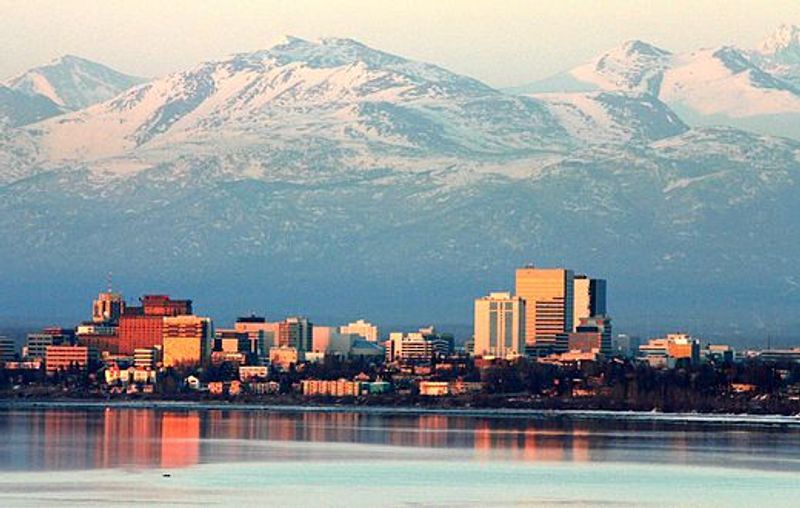

1. Anchorage, Alaska

Anchorage hits the sweet spot if you want low taxes without giving up big city conveniences. Alaska has no state income tax, and many areas keep sales tax at zero or minimal, helping every paycheck go further. You will notice the difference quickly when buying groceries or gear.

Yes, property taxes can be higher than elsewhere, but the savings on income and sales taxes often outweigh that. Outdoor lovers get trails, mountains, and ocean access right in town. If you value scenic commutes and keeping more of what you earn, Anchorage deserves a serious look.

2. Seattle, Washington

Seattle offers no state income tax, which immediately improves take-home pay for professionals across tech, healthcare, and creative fields. You will find higher housing costs, but the no-income-tax structure softens the blow compared with similar coastal hubs. Everyday amenities and strong salaries make the math compelling.

Sales and local taxes do exist, so budgeting still matters. The job market is robust, with global companies and startups fueling career growth. If you are chasing opportunity without surrendering too much of your paycheck to income taxes, Seattle’s mix of innovation and savings can work.

3. Tacoma, Washington

Tacoma gives you Washington’s no-income-tax benefit with more approachable housing than Seattle. You can still access Puget Sound jobs, arts, and outdoor adventures while keeping recurring costs in check. Neighborhoods feel livable and less rushed, which helps your budget and your weekends.

Expect sales and property taxes, but the missing state income tax keeps your paycheck healthier. The port, healthcare, and education sectors anchor local employment. If you want Pacific Northwest beauty, proximity to big-city careers, and a friendlier entry price, Tacoma’s balance of taxes and lifestyle is compelling.

4. Spokane, Washington

Spokane pairs Washington’s no-income-tax policy with a lower cost of living than the coastal metros. You will see savings reflected in rent, mortgages, and everyday expenses, letting your budget breathe. The region’s parks and riverfront trails add daily value beyond the numbers.

Sales and property taxes still factor into your plan, but overall burden often undercuts larger cities. Healthcare, education, and small business scenes provide steady opportunities. If you want a calmer pace, four seasons, and real savings from a no-income-tax state, Spokane makes a practical, comfortable landing spot.

5. Miami, Florida

Miami shines with Florida’s no state income tax, immediately boosting take-home pay for remote workers, entrepreneurs, and creatives. You will find dynamic neighborhoods, international culture, and year-round sunshine that pairs nicely with financial breathing room. The hospitality and tech scenes add momentum.

Be mindful of insurance and housing costs, which can affect overall affordability. Still, the absence of income tax plus competitive salaries can tilt the balance favorably. If you thrive on energy, beaches, and global connections while keeping more of your paycheck, Miami offers a bold, tax-friendly lifestyle.

6. Orlando, Florida

Orlando blends Florida’s no income tax with a more moderate cost profile than oceanfront cities. You will appreciate how far paychecks go toward housing, dining, and weekend fun. Beyond theme parks, the city boasts healthcare, aerospace, and tech jobs feeding steady growth.

Sales and property taxes exist, so smart budgeting still matters. Commutes are manageable in many pockets, and suburban options provide value. If you want sunshine, career variety, and a budget that stretches without state income tax biting your raise, Orlando is a practical, upbeat choice for families and professionals.

7. Tampa, Florida

Tampa offers Florida’s no-income-tax benefit with a balanced cost of living and strong job market. You will find healthcare, finance, defense, and logistics careers, plus beach weekends that do not require plane tickets. The Riverwalk and emerging neighborhoods sweeten daily life.

Insurance and property taxes vary by location, so compare carefully. Even so, take-home pay typically stretches further than in many coastal metros with income taxes. If you want a sunny lifestyle, professional growth, and fewer tax bites from your paycheck, Tampa’s steady affordability and momentum make it stand out.

8. Jacksonville, Florida

Jacksonville delivers a low overall tax burden anchored by Florida’s no income tax. You will see value in housing, ample suburbs, and easy access to beaches and riverfront parks. The economy spans logistics, military, finance, and healthcare, offering resilient employment options.

Property taxes and insurance vary by neighborhood and proximity to water. Still, the combination of reasonable costs and no state income tax helps paychecks go further. If you want space, sunshine, and a friendly budget without sacrificing amenities, Jacksonville’s blend of savings and lifestyle is compelling and practical.

9. Dallas, Texas

Dallas pairs Texas’s no state income tax with a powerhouse job market in tech, finance, and telecom. You will discover neighborhoods for every budget, from urban high-rises to family suburbs. Dining, sports, and arts deliver big-city energy without coastal income tax hits.

Sales and property taxes are part of the equation, so plan for those in your budget. Still, career growth and competitive salaries often offset them. If you want scale, opportunity, and an income-tax-free paycheck, Dallas makes a compelling, pragmatic base for building wealth and lifestyle.

10. Austin, Texas

Austin combines Texas’s no income tax with a creative, entrepreneurial heartbeat. You will find tech jobs, music, and outdoor recreation that keep life interesting while protecting take-home pay. Housing costs have risen, but thoughtful neighborhood choices can steady your budget.

Property and sales taxes require planning, so run the numbers for your situation. The city’s talent pipeline and startup culture create mobility and resilience. If you crave innovation, tacos, and a leaner tax hit on your salary, Austin offers a fun, future-forward home base with real savings potential.

11. Houston, Texas

Houston’s no state income tax pairs with a vast economy covering energy, healthcare, aerospace, and logistics. You will often find affordable housing relative to income, which stretches budgets further. The city’s food and culture scene delivers value beyond spreadsheets.

Be ready for higher property taxes and consider flood zones when picking neighborhoods. Even with those factors, the absence of income tax and strong salaries can win out. If you want big-city opportunity with a pragmatic cost profile, Houston helps you keep more of what you earn while growing your career.

12. Las Vegas, Nevada

Las Vegas offers Nevada’s no personal income tax and a growing economy beyond hospitality. You will notice competitive housing options, especially off-Strip neighborhoods that keep costs in line. Sunshine, hiking, and a strong airport simplify travel and fun.

Sales tax and homeowner association fees can apply, so compare areas carefully. The city has expanded into sports, logistics, and tech, broadening job prospects. If you want a lively environment, quick weekend getaways, and lower taxes siphoning less from your paycheck, Las Vegas makes saving feel surprisingly effortless without sacrificing excitement.